The Power of the 'MRT Effect': Is It at Work in Tanah Merah?

Chances are, we’ve all griped about its periodic malfunctions or jam-packed carriages at some point of time. But despite the occasional inconvenience, the Mass Rapid Transport (MRT) system remains an integral part of Singapore’s transport system as well as the daily commuting experience of most local residents.

Based on the latest SBS Transit figures available, the combined average daily ridership for the North East Line (NEL), Downtown Line (DTL), as well as the Sengkang and Punggol Light Rail Transport (LRT) surpassed 1 million passengers in December 2022.

It’s also worth noting that this number doesn’t account for users of other MRT lines, such as the East-West Line (EWL) and Circle Line (CCL) to name a few, which are also part of Singapore’s public train system.

A route map of Singapore’s MRT system in the late 80’s.

That being said, high ridership numbers aren’t the only thing worth highlighting about Singapore’s MRT system. Just like HDB flats and Changi Airport, it’s seen by many as a national icon that “represents Singapore’s journey from Third World to First”.

The completion of the North-South line, Singapore’s first and oldest MRT line, dates back to 1987 and it was planned to run through densely populated housing towns like Toa Payoh and Ang Mo Kio to enhance their liveability.

Fast forward 36 years later, many new housing developments – both public and private – continue to be co-located with MRT stations, thus underscoring the importance of urban transport in residential planning.

What exactly is the ‘MRT Effect’?

No doubt, convenience is one of the biggest perks that’s afforded by living near an MRT station. But an even bigger one, especially if you’re a property upgrader to-be or investor, is the promise of higher property values, and possibly, that of future profits through a successful sale.

If you find yourself penning down these desired outcomes on your list of home ownership goals, then you’ll be pleased to know about the ‘MRT effect’, which suggests that the value of a property is directly linked to its proximity to an MRT station.

Back in 2017, a study by a National University of Singapore team was conducted to examine the ‘MRT effect’ in detail. And research outcomes revealed that the (then) newly-opened CCL had a positive effect on non-landed private property values in the area, increasing average prices by 1.6%.

Furthermore, in the same study, it was found that houses located within a 400m radius of the nearest MRT station sold for 4.2% higher than their counterparts that fell outside the bounds.

Putting things in a nutshell, owners and/or sellers with homes near MRT stations have reason to rejoice.

Is the ‘MRT Effect’ at work in Tanah Merah?

To find out whether the ‘MRT effect’ is at work in Tanah Merah, we first identified a number of non-landed private property developments based on several shared criteria; this is such that the chosen examples would:

Have a tenure of 99 years

Be located within District 16

Be located within a 500m radius of Tanah Merah MRT station

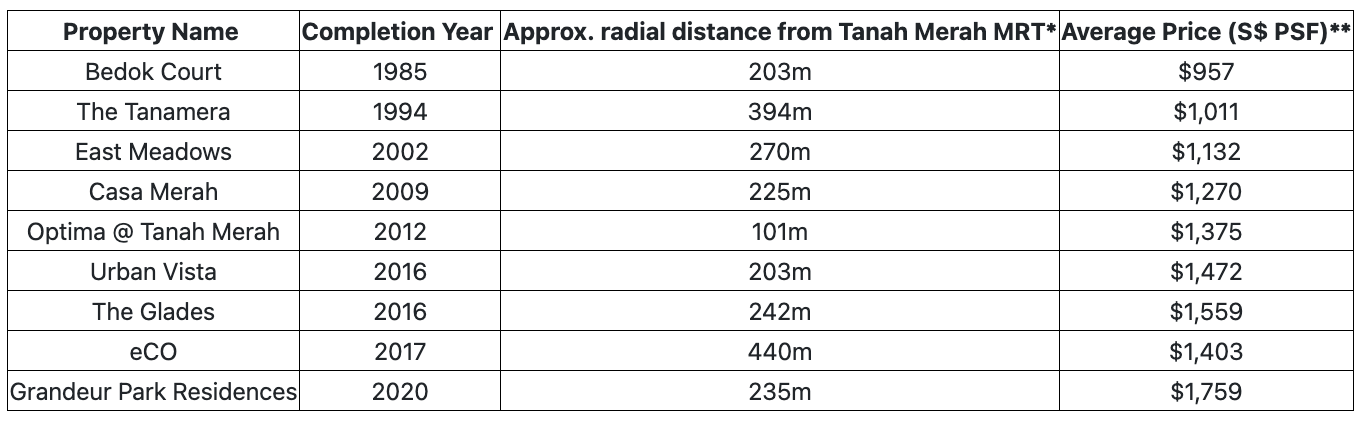

And here are the developments themselves, plus more relevant details:

(*Data obtained from One Map. **Price data from Squarefoot research by EdgeProp.)

Also, as a basis of comparison, here are the average per square foot (PSF) prices for 99-year condominiums in District 16 for the last six months:

(*Data obtained from ERA SALES+ app.)

From these tables, it can be deduced that it’s indeed possible for 99-year condominiums within a 400m radius of Tanah Merah MRT to enjoy better PSF property values than the six-months average for D16 ($1,348). Examples include Optima @ Tanah Merah ($1,375), Urban Vista ($1,472), The Glades ($1,559), and Grandeur Park Residences ($1,759).

However, it’s also worth mentioning that the ‘MRT effect’ is most observable for Tanah Merah developments that were completed within the last decade.

For instance, even though Bedok Court has a similar radial distance from Tanah Merah MRT station as Urban Vista (both 203m), it has a lower average PSF price than its more recent counterpart that was completed in 2016.

Likewise, although eCO falls just outside the 400 m radius of Tanah Merah MRT station, its homes are valued above the D16 average too ($1,403 VS $1,348).

Or in other words, aside from the ‘MRT effect’, age matters too.

Sceneca Residence – New homes that could gain from the ‘MRT Effect’!

Even at a glance, there’s plenty to support the belief that homes in Sceneca Residence will be worth the investment.

Aside from being a mixed-use development that comprises of Sceneca Square – a 20,000 sq ft retail mall with a plethora of retail, dining, and entertainment options – Sceneca Residence also enjoys the twin advantages of a fresh 99-year lease as well as a direct connection to Tanah Merah MRT station in the form of a 24/7 linkway.

Interested in knowing more about this up-and-coming condominium? Speak to us today and schedule a showroom visit during Sceneca Residence’s official launch on 14 Jan 2023 (Sat)!

Disclaimer for consumers

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salespersons accept no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.